Ways to Give

Hunter College High School Alumnae/i Association (HCHSAA)

Tax ID (EIN): 13-3953396

Restricted and Unrestricted gifts through the Annual Fund supports all your philanthropic interests and make an immediate impact.

There are several ways to make a gift to the HCHSAA:

Gifts of Cash:

Online giving through our secure online system is often the simplest and fastest way to contribute.

ACH Payments:

To make your gift through ACH payment, please contact our office at (212) 772-4079 or email: info@hchsaa.org.

Please send your completed printable gift form with your check or credit card information to:

Hunter College High School Alumnae/i Association (HCHSAA)

Hunter College East, Room 1313B

695 Park Avenue

New York, NY 10065

Wire Transfer

Please complete the following form to immediately receive our wire transfer instructions.

Stock Transfer

You can make an electronic transfer with the instructions below or click the button below to immediately receive our stock transfer instructions.

Hunter College High School Alumnae/i Assn. Inc.

Schwab Account #: 5161-3082

DTC #: 0164

If you are attempting to gift mutual funds or other types of securities, please reach out to us directly via info@hchsaa.org or (212) 772-4079 as the gifting of these assets varies and need to be addressed on a case-by-case basis.

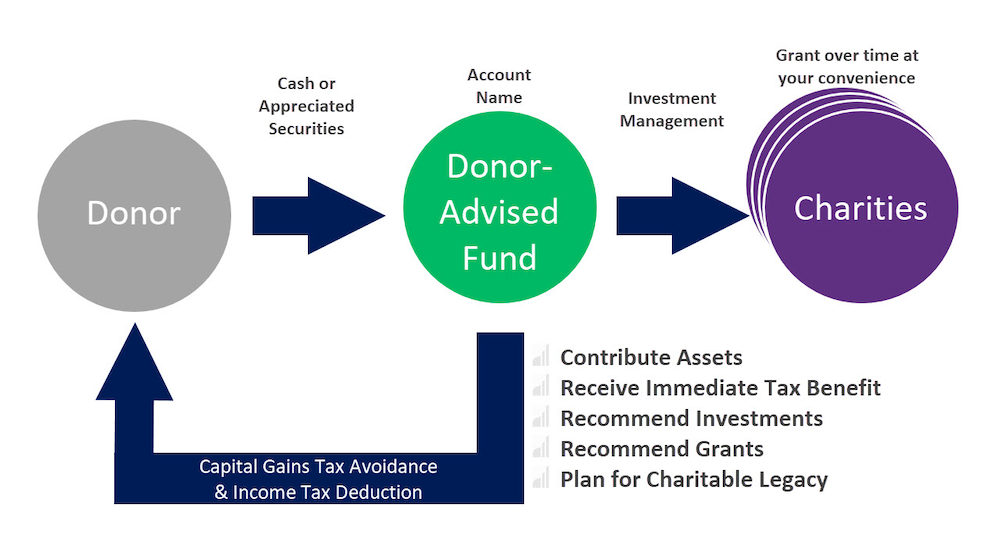

Donor-Advised Fund (DAF)

A donor advised fund is a low-cost charitable giving vehicle for making your giving simpler and more tax efficient. It is administered by a public charity created to manage charitable donations on behalf of organizations, families, or individuals.

When planning to make a gift of cash via Donor-Advised Fund, please notify our offices at (212) 772-4079

Planned Giving

Planned giving is a powerful tool that can provide an income for life and reduce or eliminate capital gains, generate a charitable tax deduction or reduce or eliminate gift & estate tax and provide a much larger gift to HCHSAA than you ever thought possible.